Increased Antitrust Pressure Forces NVIDIA to Adjust.

Media reports indicate that the U.S. Department of Justice has launched an antitrust investigation into NVIDIA, accusing the company of abusing its dominant position in the artificial intelligence (AI) chip market.

At the same time, competitors such as AMD, several AI chip startups, as well as progressive groups in the United States and Democratic senators have joined forces to pressure regulatory authorities to investigate NVIDIA's business practices.

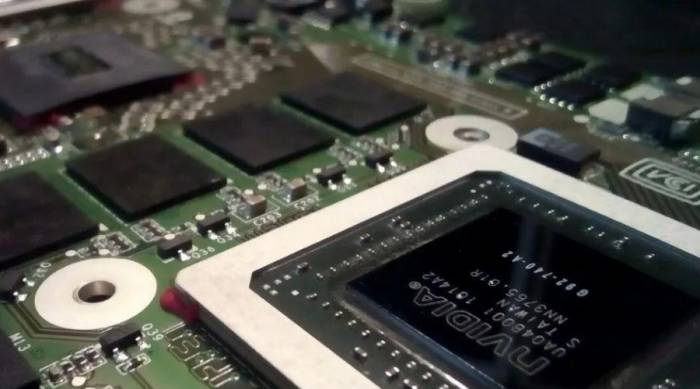

NVIDIA has been accused of threatening to penalize customers who also purchase products from its competitors and of strengthening its control over the software used by AI developers through the acquisition of startups.

Market analysis shows that NVIDIA has a market share of over 90% in the data center GPU market, almost monopolizing this field, which gives it significant pricing and sales strategy power, potentially harming the interests of competitors and customers.

The U.S. Department of Justice is investigating whether NVIDIA has exerted pressure on customers to link chip sales with the purchase of additional products, and whether it has increased prices for customers who also purchase AI chips from competitors such as AMD and Intel.In addition, NVIDIA's bundling of hardware and software has also attracted the attention of regulatory authorities, especially its programming software ecosystem CUDA, which can only be used in conjunction with NVIDIA chips. This is considered to be a behavior that locks in customers and stifles innovation.

Advertisement

NVIDIA responded by saying that this is a victory based on strength, the company strictly complies with all laws, and ensures that each customer can choose the most suitable solution for them.

The U.S. antitrust investigation has impacted NVIDIA's stock price, with the company's stock price falling by 2.3% at one point on the Frankfurt stock market in Germany on the 2nd.

NVIDIA is being investigated in France

On July 15, the French Competition Authority confirmed that it is investigating NVIDIA, with the investigation involving anti-competitive behavior.

If the above investigation has results, it means that NVIDIA will be prosecuted and become the first company to be prosecuted under the new French regulations for suspected anti-competitive behavior.

Although the specific charges are not yet clear, they seem to be mainly aimed at NVIDIA's cloud computing business.

In fact, this is not the first time NVIDIA has been at the center of a storm. As early as last September, the French Competition Authority conducted a surprise inspection of companies related to the "graphics card industry." The Wall Street Journal later reported that the target of that raid was NVIDIA. Such surprise inspections usually include the seizure of physical and digital materials and questioning of employees.

In June of this year, the French government released a competition report on the generative AI market, pointing out risks related to chip suppliers.

According to the latest reports, the French regulatory authorities' concerns about NVIDIA's monopoly of the market still revolve around two aspects: one is the dependence of the graphics card industry on NVIDIA's CUDA chip programming software; the other is that NVIDIA has recently invested in start-up cloud computing companies focused on artificial intelligence, such as CoreWeave.NVIDIA Under Investigation, Perhaps the Beginning of a Troublesome Autumn

A year ago, NVIDIA's market value had not yet reached 1 trillion USD, lagging behind tech giants such as Alphabet (Google's parent company), Amazon, Apple, and Microsoft.

However, under the heat of the artificial intelligence (AI) boom, NVIDIA has been continuously pursued, and its stock price surge can be described as "the strongest on earth." In May, it reported growth in financial statements, and in June, it underwent a stock split. Its market value once reached 3.34 trillion USD on June 18, standing at the top of the world, surpassing Microsoft (3.317 trillion USD) and Apple (3.286 trillion USD).

In just over a year, it created a market value of more than two trillion, directly challenging the global lead.

But while the stock price has reached new heights, NVIDIA's founder and CEO, Huang Renxun, has been intensively reducing his stock holdings. Public information shows that Huang Renxun reduced his company's stock holdings from June 13 to 24, 2024, selling a total of 840,000 shares and cashing out more than 100 million USD. On June 24 alone, Huang Renxun cashed out 14.5 million USD.

NVIDIA's stock price has soared by two trillion, and there has always been concern about its high valuation and bubble. So, can NVIDIA really lead an era? Will this antitrust investigation be the beginning of a troublesome autumn for NVIDIA?

All of NVIDIA's current prosperity is based on the market's optimistic expectations for the bright future of AI technology. People believe that AI will bring an increase beyond the Internet for PCs, and the mobile Internet for PC Internet, and expect this change to happen quickly.

So this is more like an investment based on optimistic expectations of AI. And the growth is more driven by the hoarding demand brought by the explosion of AIGC, rather than the actual industrial demand.

And the capital expenditure of AIGC will eventually face limits. If the technological breakthroughs do not continue, and the terminal application payments do not meet expectations, the current inventory accumulation may turn into a de-stocking process that lasts for several years. That is, if the downstream cannot develop stable and relatively strong profitability in time, NVIDIA, as a "seller of shovels," will eventually face a decline in shovel sales.

Therefore, it is not simple to use the performance growth rate of the past two years as a linear prediction of future growth. It also depends on whether the long-term performance still depends on whether the customer's investment in AI can be transformed into actual income.From the perspective of the current commercial penetration rate of AID, the progress of AI seems to be slower than expected. For instance, Meta has used AI to improve advertising, achieving a doubling of profits, but it has also implemented strict cost-cutting measures, making it difficult to determine whether the increase in profits is entirely due to the application of AI. Microsoft and Amazon's AI services have just been launched, and there is a lack of specific data to support them.

Therefore, how to break through the profit mechanism of AI in downstream business and industrial fields, and create greater commercial value and productivity value, will be the "Wall of Lamentations" that Nvidia is about to encounter. Facing this "Wall of Lamentations," if only "patching up" the existing AIGC system, it will ultimately be difficult to make the ideal a reality.

*Statement: This article is the original creation of the author. The content of the article is the author's personal opinion. Our reposting is only for sharing and discussion, and does not represent our approval or agreement. If there are any objections, please contact the backstage.

Comments